Your current location is:Fxscam News > Exchange Dealers

Bitcoin heads toward $70,000, fueled by global monetary easing.

Fxscam News2025-07-23 06:04:00【Exchange Dealers】8People have watched

IntroductionForex app mt4,Which foreign exchange trading platform is the most reliable,Boosted by global loose monetary policies, Bitcoin is experiencing a new wave of growth. A recent re

Boosted by global loose monetary policies,Forex app mt4 Bitcoin is experiencing a new wave of growth. A recent report from 10X Research predicts that, influenced by the Federal Reserve's rate cuts and China's large-scale quantitative easing policies, Bitcoin prices are likely to break through $70,000 and set new highs by the end of October.

Over the past month, the price of Bitcoin (BTC) has increased by more than 10% and is now stable above $65,000, up over 30% from the previous local low of $49,000. This strong momentum has significantly boosted market confidence, with analysts optimistic about its long-term development prospects.

Bitcoin's current market price is higher than the average realized value over the past year, indicating growing confidence among long-term investors and suggesting a more permanent uptrend.

The latest report from 10X Research further analyzes Bitcoin's market outlook. The report indicates that Bitcoin has successfully reversed its previous downward trend and is moving towards the $70,000 mark, with expectations to surpass this level within two weeks. As the end of October approaches, the market anticipates Bitcoin will reach new historical highs.

In addition to the Federal Reserve's rate cut cycle, 10X Research also emphasizes that China's loose policies will increase global liquidity, leading to a parabolic price rise in the cryptocurrency market. Previously, Bitcoin had once surged above $73,000 following events like the halving event, Trump's support, and the listing of Bitcoin ETFs. This time, it may be gearing up for another wave of growth.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(855)

Related articles

- Yellow Corp files for bankruptcy amid union disputes, risking US taxpayer losses.

- The latest list of scam cryptocurrency exchanges exposed.

- Euro at turning point as Germany's CPI hits 2% ECB target,Lagarde warns of inflation volatility

- CBOT grain trends diverge, with weather and international demand as key variables.

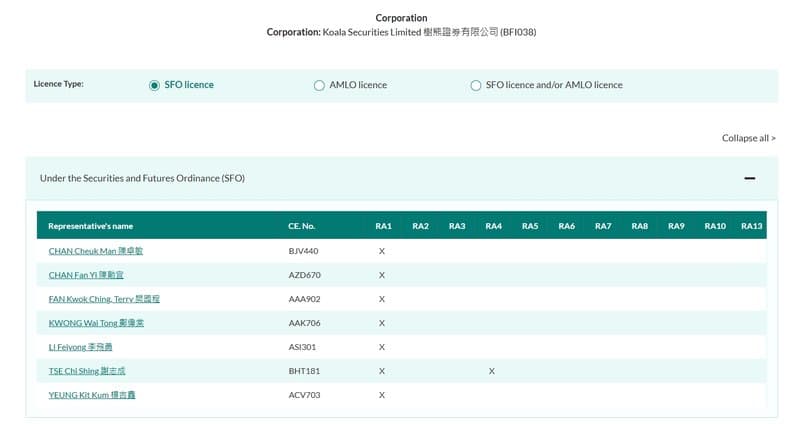

- SFOCL is a Scam: Stay Cautious

- Tesla's free cash flow may turn negative, Wells Fargo maintains "sell" rating.

- Bitcoin and Ethereum Plummet.

- Trump announces tariff deal with Vietnam, imposing 20%+ on exports while US grants duty

- The fall in the occupancy rate cannot prevent Manhattan rents from reaching a new historical high.

- Digital Wallets Propel Payment Innovation: Expected to Account for 50% of Global Sales by 2027

Popular Articles

Webmaster recommended

Bitcoin Surges Beyond $44,000! Bullish Comeback or a Feint Move?

The European Retail Sector Distress Index Hits its Highest Level Since the Financial Crisis

Trump warns Japan of possible 35% tariffs, rules out extension of “tariff deadline”

With $5.8 billion in options contracts nearing expiration, can Bitcoin hold its key levels?

Market Insights: Dec 11th, 2023

Trump announces tariff deal with Vietnam, imposing 20%+ on exports while US grants duty

British companies are shifting their investment focus towards domestic markets and India.

The US economy faces three major policy challenges.